For African countries, a persistently weak currency can be more than a nuisance. It can be a serious obstacle to growth, stability, and prosperity.

- Business Insider Africa presents the top 10 African countries with the weakest currencies in April 2025.

- This list is courtesy of the Forbes currency calculator.

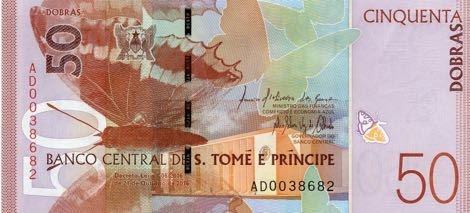

- São Tomé & Príncipe ranks number 1 on the list.

In today’s global economy, currency strength is more than just a technical economic metric; it reflects a country’s economic health, governance, and competitiveness in global markets.

With rising geopolitical tensions, global interest rate hikes, and the ongoing tariff battles between major economies like the U.S. and China, the vulnerabilities associated with weak currencies could prove to be even more harmful.

The implications of a weak currency also go beyond economics, affecting social welfare, national security, and long-term development.

Over time, subjection to external financial forces, owing to a weak currency, can undermine national decision-making.

SEE ALSO: Top 10 African countries with the strongest currencies in March 2025

Countries may be obliged to implement policy measures prescribed by foreign entities to qualify for loans or debt relief.

These frequently include subsidy elimination, tax hikes, or reductions in social spending, measures that can be politically contentious and socially damaging.

A weak currency reduces not just a country’s economic might, but also its political sovereignty; however, the financial consequences are very glaring.

DON’T MISS THIS: Africa’s best-performing currency helps Uganda slash power prices in 20 years

![A vendor counts out Nigerian naira banknotes inside a shop at the Ikeja computer village market in Lagos, Nigeria. [Getty Images]](https://ocdn.eu/pulscms/MDA_/0b477b934604f85231b56a2db3047569.jpeg)

For example, the most obvious and severe consequences of a weak currency are inflation, particularly on imported products.

African countries frequently rely substantially on imports of petroleum, medicine, food, machinery, and technology.

When the local currency loses value, importers have to pay extra to get these items into the nation, which is swiftly passed on to consumers.

With that said, here are the weakest currencies currently according to the Forbes currency converter, last updated on the 22nd of April 2025.

Top 10 African countries with the weakest currencies in April 2025

| Rank | Country | Currency value per US$ | Currency |

|---|---|---|---|

| 1. | São Tomé & Príncipe | 22,281.8 | São Tomé & Príncipe Dobra |

| 2. | Sierra Leone | 20,969.5 | Sierra Leonean Leone |

| 3. | Guinea | 8,655.5 | Guinean Franc |

| 4. | Uganda | 3,664.2 | Ugandan Shilling |

| 5. | Burundi | 2,930.0 | Burundian Franc |

| 6. | Democratic Republic of the Congo | 2,877.0 | Congolese Franc |

| 7. | Tanzania | 2,685.0 | Tanzanian Shillings |

| 8. | Malawi | 1,736.0 | Malawian Kwacha |

| 9. | Nigeria | 1,604.7 | Nigerian Naira |

| 10. | Rwanda | 1,415.0 | Rwandan Franc |